Tax On Recreational Gear To Help Fund WDFW Gets Hearing In Olympia

An idea whose time has come, an “unfixable” one — or something in between?

Washington lawmakers heard all sides during a hearing on a bill that would add a .20 percent tax on certain recreational equipment and clothing over $200 to help fund the upkeep of WDFW-owned fish and wildlife habitat.

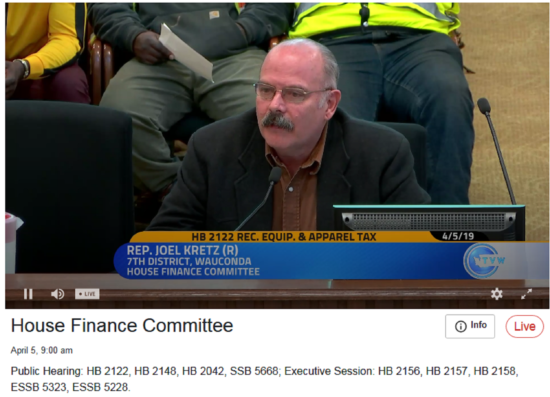

Citing a ring of invasive knapweed around a state wildlife area sign in Okanogan County, prime sponsor Rep. Joel Kretz (R-Wauconda) said he was trying to fix a long-standing problem for the agency since the Great Recession chopped a big part of state General Fund support for its myriad missions.

“I think $2 million would give us a start,” he told members of the House Finance Committee.

That’s how much a fiscal note says HB 2122 as initially written would raise on average over the coming six years for WDFW’s Wildlife Account, from $800,000 in 2020 to $2.9 million in 2025

Hunters and anglers presenting their licenses at that point of sale would be exempt as we already pay through federal excise taxes via the venerable Pittman-Robertson and Dingell-Johnson Acts.

“That group has been paying the freight for a pretty long time,” Kretz pointed out.

However, representatives from the retail industry say they oppose it, including for its broad language and the dollars that outdoor activities already generate for local economies and state taxes — $26 billion and $2 billion, according to Mark Berejka of Seattle recreational giant REI.

“This bill is not a fix and it is not fixable,” he said.

He also questioned how the sportsman exemption would work when buying items online, and complained that the bill had been “sprung” on his industry.

James Moshella of the Washington Trails Association said his group was opposed, but that if such a tax was going to be imposed it needed to have a broader conversation and also should benefit all state lands — WDFW, DNR and State Parks — that hikers use.

Organizations closer to WDFW’s mission expressed support.

Jen Syrowitz, a hunter and hiker with Washington Wildlife Federation, called the bill a “fair ask of the recreational community.”

She said there was a “disconnect” between state residents and our wildlife and the bill would help everyone understand they’re all stakeholders in WDFW carrying out its conservation mission.

Syrowitz called the tax nominal, and in offering Audubon Washington’s support, Adam Maxwell said it amounted to “60 cents on a pair of Nikon Monarch binoculars.”

He said that the dollars WDFW receives generate a 350 percent return on investment to state coffers.

Calling himself an avid hiker and photographer, Chris Bachman of Spokane’s The Lands Council said, “I’m glad to pay the tax.”

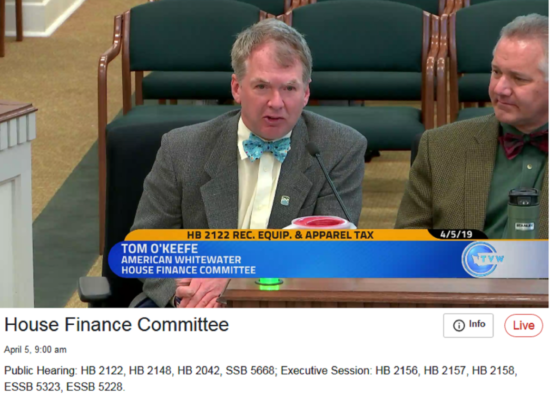

He added that what would be taxed under the bill needs to better defined, a work-in-progress sentiment that was echoed by Tom Echolls of the Hunters Heritage Council and Mitch Friedman of Conservation Northwest. The former gentleman signed in as “other,” the latter in support.

Also testifying was WDFW’s Nate Pamplin, which said his agency was supportive of the intent of the bill, which came out of legislative requirements for state fish and wildlife overseers to review their operation, conduct an audit, look for efficiencies and convene stakeholders, the Budget and Policy Group, or BPAG.

He said that that found that the department’s mission benefits all Washingtonians, and it should be funded that way.

Asked by Rep. Ed Orcutt (R-Kalama) how much WDFW lost in General Fund revenues due to the recession 10 years ago, Pamplin said funding went from $110 million in the 2007-09 biennium to $75.6 million in 2009-11 to $57.7 million in 2011-13. While it recovered to $94.4 million in the current two-year budget cycle, with inflation it’s still $30 million below where it might otherwise be.

Rep. Kretz said the dropoff could be seen in “lapses in management” and in his opposition to habitat acquisitions, such as Scotch Creek, where the aforementioned weed-ringed wildlife area sign stands.

“We really appreciate the sponsor [Kretz] for thinking outside the box and this committee for holding the hearing,” Pamplin said, adding that he looked forward to working with stakeholders on the bill.